In its brief 12 years of existence, Bitcoin has gone from being simply another alternative to e-money, to a wildly popular movement that may lead to the total disruption of the way in which the entire world handles its money. However, despite its rapid adoption rate, many skeptics are doubtful of Bitcoin’s longevity. There are a number of hurdles Bitcoin and cryptocurrency must overcome if it wants to permanently transform global finance. Will Bitcoin and cryptocurrency be able to lead its future, or is this all just a passing phase?

Before we get to this, however, many of us are probably still getting our heads around the concept of cryptocurrency to begin with.

So what exactly is cryptocurrency?

Essentially, it’s a peer-to-peer electronic cash system that eliminates the need for services usually provided by a traditional bank. Specifically, using a database technology known as Blockchain, Bitcoin neither stores nor maintains its records through a single intermediary or administrator. Instead, everything gets verified by what could be thousands of independent sources. It’s basically a public database.

However, this public information doesn’t include the person’s name nor IP address, so it’s considered relatively safe. Hence its popularity.

The only information that we see is the transfer itself, from one person’s digital wallet to the next (plus the date and time of transfer).

These records are permanently stored on Bitcoin’s blockchain, which is essentially tamper proof. Because, again, it is not maintained by a single source but rather thousands from around the world. The appeal, therefore, is that by having a large number of unbiased supervisors, transactions can be handled more efficiently and reliably than what might go on inside a private bank.

Just how popular is Bitcoin?

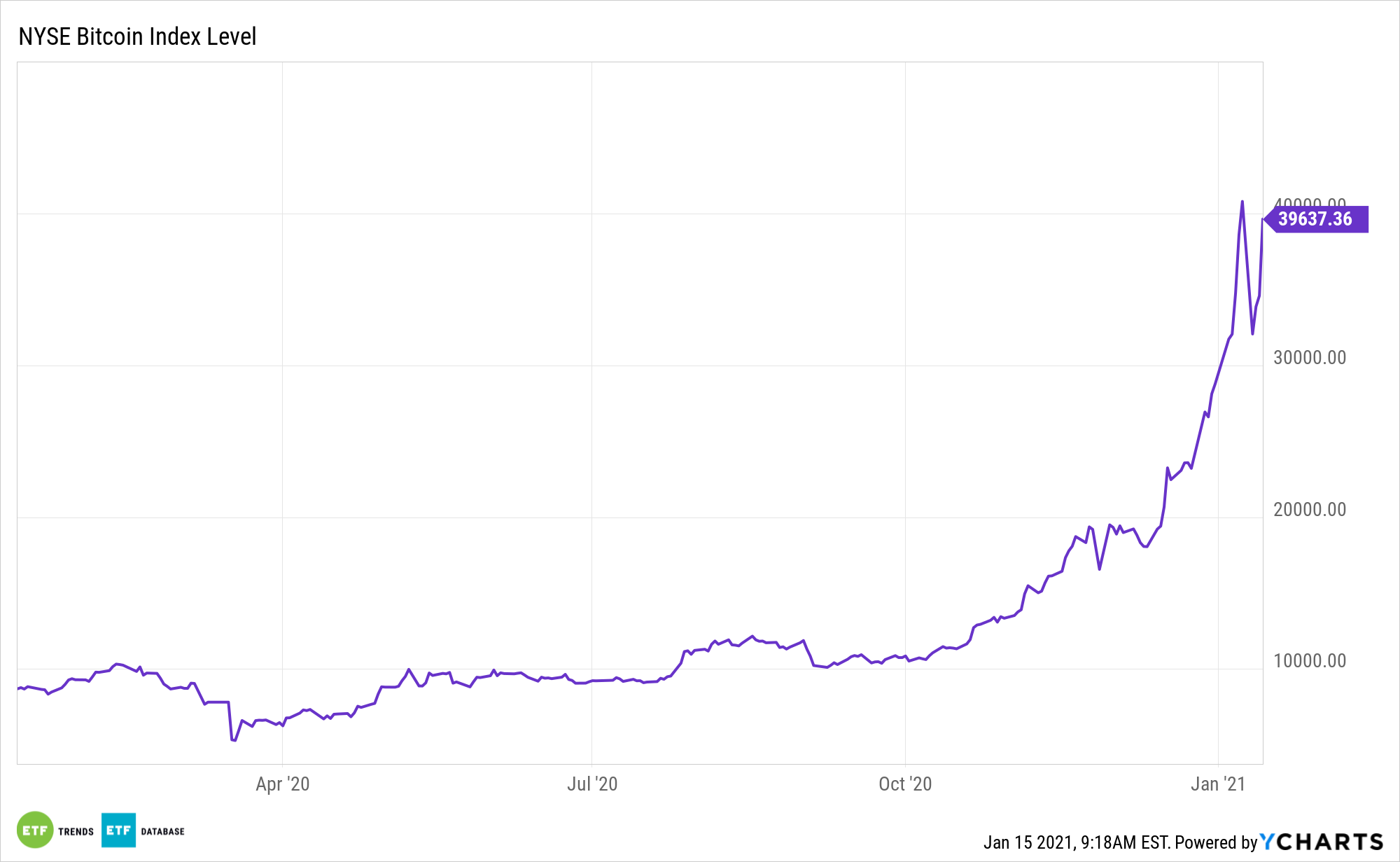

The above S-curve (which measures the adoption of new technologies) shows us the rise of Bitcoin popularity in the last year, which has skyrocketed since last November. It’s expected… Bitcoin is in the Early Majority stage of adoption. We know this based on the number of global investors and total amount invested so far. (There are five stages in total; Innovators, Early adopters, Early majority, Late majority and Laggards.)

It’s plain to see, then, that this adoption S-curve has been the demanding force behind Bitcoin’s stellar returns. (Bitcoin valued at $100 in 2011 was estimated to be worth over $2 million at the end of the decade. That’s quite a jump!)

So what happens if other industries were to cash in on this phenomenon?

A Future of Disruption

Disruption is possible for any industry or organisation that uses any kind of transaction or mass record keeping. We outline some of the possible disruptions for different industries below.

Banking

The banking sector may adopt a total streamlining of global transactions, which would in turn speed up payments and potentially remove restrictions posed by currency borders.

Media

Evidence of ownership rights will be demanded and provided more efficiently, which will assist with anti-piracy and copyright infringement action.

Voting

Blockchain methods may prove useful in reducing voter fraud, minimise government fraud and increase accountability and compliance for government officials.

Medical

Drug supply chain management could become more effective, with patient databases fully available on blockchain.

Of course, these predictions are only ideal in relation to cryptocurrency’s current potential. As we mentioned before, there are still a number of hurdles cryptocurrency needs to overcome if it wants to be the new norm in finance.

What are Cryptocurrencies current obstacles?

One of the main problems with cryptocurrency is that it has more in common with equity markets than, say, something like gold. Massive volatility could therefore plague cryptocurrency’s future, which has either made investors fortunes or completely destroyed them.

Then there’s the question of technological stability and security. A simple computer crash could erase one’s entire digital fortune, or a hacker could take over a virtual vault.

However, technological advances could overcome these in time.

Other possible hurdles include scalability, central banks, and the outright banning of transactions denominated in cryptocurrencies in some countries.

Above all, however, perhaps the biggest threat to the survival of cryptocurrency will be that the more popular it becomes, the more regulation and government scrutiny it is likely to attract, which will fundamentally eliminate the premise for its existence in the first place.

What do you think? Does Bitcoin and cryptocurrency have a fair shot at taking over the world? Or is it too idealistic?